How to Manage Your Daily Spending in College/University

September 06, 2019

EasyUni Staff

So, you’ve managed to land yourself in college/university and are now worrying about handling your finances? Firstly, congratulations on making it! Needing to manage your expenses can be quite daunting, especially if you are away from the comforts of home, but if you are able to plan your finances well, you’ll find that you have very little to worry about. We’ll provide you with the most basic but fundamental guidelines and tips to make your college life run without any worries!

1. Plan your daily and weekly expenses

This goes without saying, but no matter how much you dislike planning, it’s one of the only ways for you to keep track of your spending habits. Plan how much you’re willing to spend in a day, and if possible, how to reduce the amount. For example, if you have to spend three dollars daily on a bus to campus, make sure you add that to your daily budget. Then plan how much you can spend a day for food and other necessary expenses, and calculate how much you will be spending in a week. Make sure you include a little extra for other miscellaneous expenses and emergencies. By the end of each week, if you’ve spent less than you were supposed to, you’ll have extras to save or go shopping with.

2. Go green.

It’s always advisable for students to minimise the costs that they incur in their everyday lives. If cycling is a reasonable option to go around your university, invest in a bike – you’ll find that the cost of the bike will (usually) be worth more than the cost of all the money you put into your bus fares throughout the duration of your study. If you need to read a lot of softcopy notes, perhaps you should invest in a Kindle instead of spending your money printing your notes on paper. Investments are always good for the long run, but evaluate properly first on how useful it will be for you.

3. Don’t drive.

Unless if you are living way off-campus, driving shouldn’t be something for you to consider while you are in college/university. Most colleges and universities are situated in areas that are easily accessible by public transport, and are near enough to places for you to shop. Having a car definitely looks cool, but consider the price of fuel and insurance, not to mention maintenance and repairs. The costs incurred will be a nightmare if you’re trying to live on a tight budget.

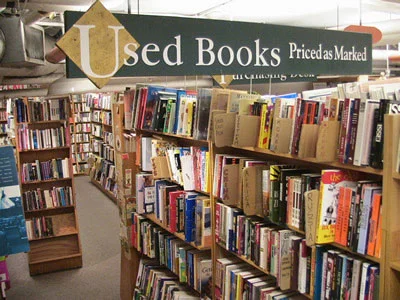

4. Buy and sell used books.

You’ll usually find seniors who are more than willing to sell their used textbooks at a much cheaper price compared to buying them new. Unless if these books are of a very outdated edition, consider purchasing your books from them. It won’t have the new book smell, but it will definitely allow you to cut back your expenses. If you’re lucky, your senior will have written decent notes and have highlighted important parts in the textbook that can help you in your studies. Unless if you wish to keep all your textbooks, you can also sell them back to your juniors after you have finished using them.

5. Use school resources.

There are usually shops and cyber cafés that make money by providing printing and internet services, but firstly, check to see if your university offers these – they should, at a lower cost if not free of charge. Make use of these services as they are provided exclusively for you. The same goes for your daily meals. Student halls usually offer much cheaper meals, and they are also nearer than going out to the city for your favourite, expensive dishes!

6. Make use of student discounts.

There are many student discounts available out there, depending on the location of your university. This ranges from leisure activities, to meals, to buying academic books, to many other things. Make use of these student discounts to minimise cost and make full use of your status as a student.

7. Avoid credit cards.

It’s always fun to shop with credit cards, but these can make you lose track of your finances and before you know it, your bank account will be running on a deficit than a surplus. Use cash at all times if possible, as it will make you more aware of the money coming in and out of your pocket.

Needing to manage your expenses shouldn’t be the reason to not enjoy college. Be smart, spend wisely, and you’ll find that your college experience can run just as smoothly no matter where you are!

Do you have any tips on careful spending for college/university? Discuss in the comments below.

You might be interested in...

- Sunway University launches New Medical School to transform Healthcare Education

- What to Do After IGCSE/O-Level? Best Study Pathways in Malaysia

- Xiamen University Malaysia Scholarships for International Students in 2025

- Why AI in Education Matters?

- EdUHK Wins Grand Prize at iCAN 2024 Achieves the Best Performance among Hong Kong Universities

- Sunway University Ranked Malaysia's No. 1 Private University in 2025

- A Sunway University Student's Journey from Cerebral Palsy to Graduation

- APU Dominates the 2024 Private Education Excellence Awards with Dual Wins

- The Young & the Wired: How Youth are Redefining the Digital Era?

- Promoting Inclusivity at Malaysian Universities: Tips for Malaysian and International Students

+60142521561

+60142521561